Healthy Soda Revolution 2025: Prebiotic & Plant-Based Soft Drinks Rise in the U.S.

Introduction - Appeal of Guilt-Free Sodas

Consumers in the U.S. are increasingly seeking soft drinks that feel indulgent yet avoid traditional downsides-high sugar, artificial additives, and empty calories. Healthy soda brands promise refreshment with plant-based fibers, prebiotics, and zero or reduced sugar, offering a softer alternative to classic sodas while appealing to health and wellness trends.

What Makes a Soda “Healthy”? - Prebiotic, Probiotic, Plant Fiber

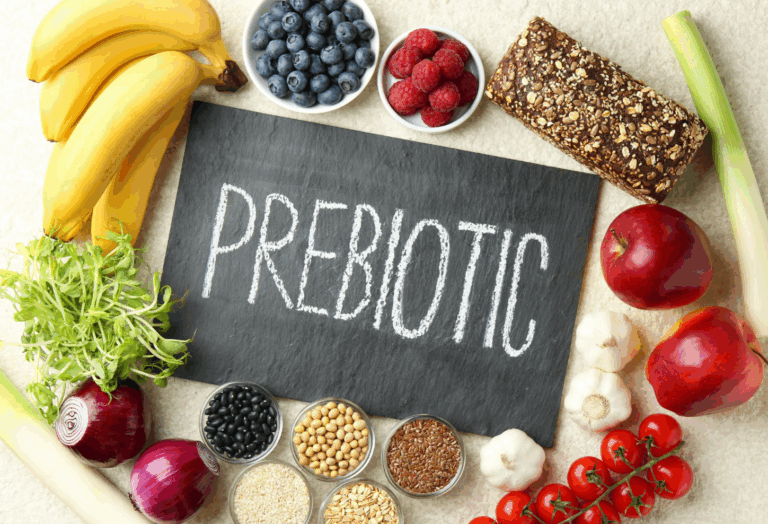

Prebiotics: Ingredients like inulin, chicory root, agave fiber help feed good gut bacteria. Brands like Poppi and Olipop use these to create soft drinks that support digestion.

Plant-based ingredients: Sweeteners, flavors and natural fruit juice, moving away from artificial sweeteners. Cleaner labels.

Probiotics / Fiber: Some healthy sodas introduce live bacteria or fiber to support gut health. The difference and regulatory claims vary by market.

Leading Brands in This Space: Olipop, Poppi, Coca-Cola’s Simply Prebiotic

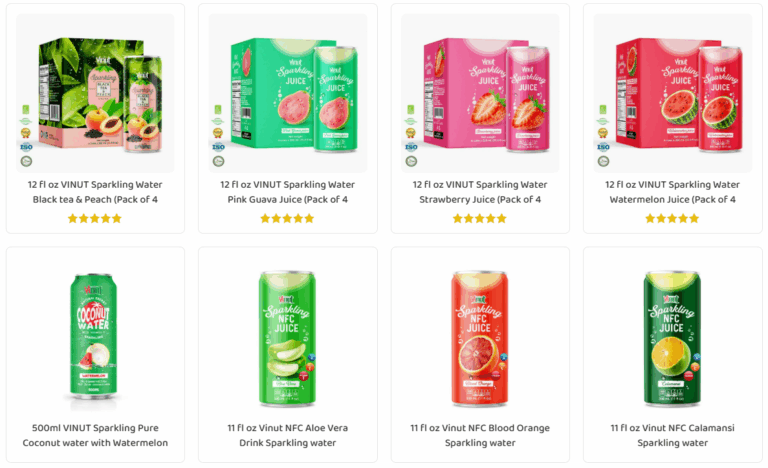

Vinut: Building on its global success in aloe vera drinks, coconut water, and fruit-based beverages, Vinut is actively exploring formulations with prebiotic fiber and plant-based innovation. Positioned as an export-ready Vietnamese brand, Vinut is aligning with the healthy soda trend to bring functional, low-sugar alternatives to international markets.

Poppi: Iconic prebiotic soda acquired by PepsiCo in 2025 for ~$1.95B. Known for apple cider vinegar, low sugar and gut-friendly blend.

Olipop: Strong growth; rich plant fiber base, flavor variety, positioning as lifestyle soda rather than just diet alternative.

Coca-Cola • Simply Prebiotic: Launched in 2025 with 6g fiber, zero added sugar, using real juice plus plant-based sweeteners/fibers. A major entry by legacy brand into healthy soda.

Consumer Data, Influencers & Sales Growth

According to beveragedaily.com, The U.S. prebiotic and probiotic soda market is projected to reach ~$268 million by 2030, with ~7.8% CAGR.

Global market trends mirror this growth, with a projected ~$766 million in value by 2030 for similar beverage lines.

Influencers, social media (TikTok, Instagram) are major drivers, especially for Olipop and Poppi. Consumers younger (Millennials, Gen Z) value gut health, plant-based labels.

Formats & Flavors

Available in slim cans as well as sparkling sodas, with flavors like lemon, strawberry, ginger, peach, raspberry, lime.

Zero sugar or low sugar formulations, often under 5g sugar per can; sometimes sweetened with stevia, monk fruit or natural alternatives.

Implications for Vietnamese Brands

Vietnamese beverage exporters should consider developing healthy soda lines with prebiotic fiber, plant-based flavors, low sugar - aligning to U.S. regulatory expectations.

Need to ensure label accuracy, regulatory compliance for health claims (e.g., “supports digestion”), especially for export.

Also, positioning, branding, shelf space (health food stores, online, supermarkets) will matter - consumers willing to pay premium for healthy soda.

Conclusion

The healthy soda revolution is more than a fad - it marks a shift in the U.S. soft drink landscape, where prebiotic & plant-based sodas are no longer niche but entering mainstream. For brands and exporters, embracing healthy soda means innovating in formulation, transparency, and branding. Those who move early will lead the new wave.

Nam Viet Group, with its portfolio of clean-label, functional beverages, is ready to capture this momentum-offering export-ready solutions that meet rising consumer demand for healthier, traceable drinks worldwide.